December 23,2017

the staff of the Ridgewood blog

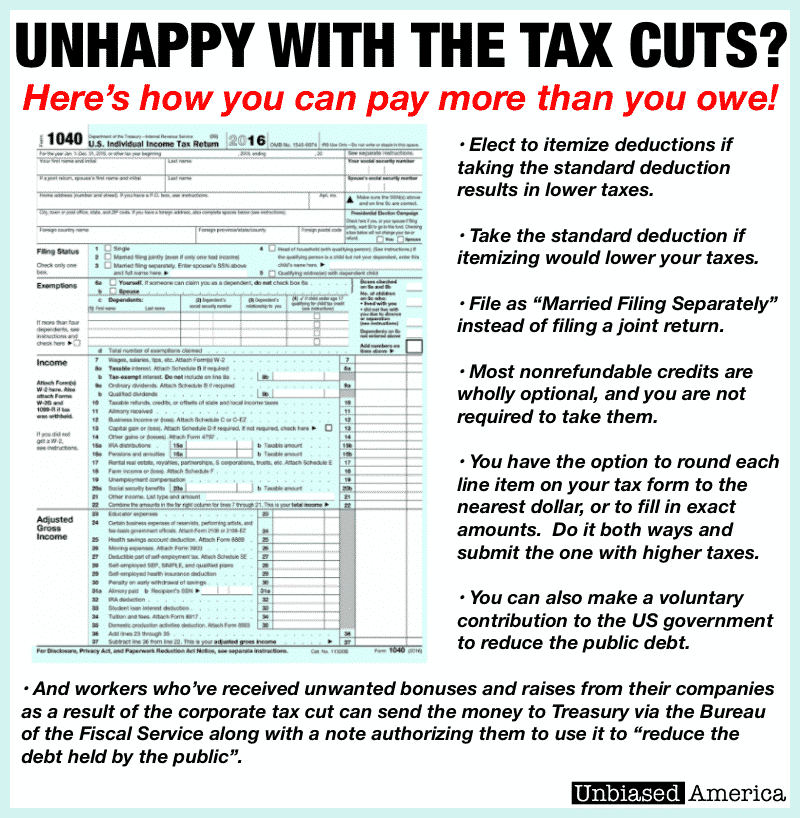

Ridgewood NJ, in “A GUIDE TO PAYING HIGHER TAXES FOR PEOPLE UPSET BY THE TAX BREAKS” by Kevin Ryan, the author spells out how you can continue paying the old higher rates .

Ryan begins , “Are you upset about the tax cuts? Have no fear! I’ve written this handy guide for people who’d like to continue paying higher taxes.”

He reminds taxpayers , “It’s not as simple as sending the government more money than your tax return says you owe. Unfortunately, the IRS will send your overpayment back to you as a refund (or apply it toward your next year taxes if you specify them to). ”

Then he gets into the options you have to pay more taxes .

However, there are options that you can select when filing your taxes that will result in you paying more money:

• Elect to itemize deductions even if the standard deduction would be greater.

• Elect to take the standard deduction if itemizing would lower your taxes.

• File as “Married Filing Separately” instead of filing a joint return will usually result in higher taxes owed.

• Most nonrefundable credits are wholly optional, and you are not required to take them if you do not want to.

• You have the option to round each entry line item on your tax form to the nearest dollar, or to fill in exact amounts. Do it both ways and submit the result that comes out with higher taxes.

• You can also make a voluntary contribution to the US government by sending a separate payment to the Treasury via the Bureau of the Fiscal Service along with a note authorizing them to use it to “reduce the debt held by the public”. Be careful, though, such contributions are tax deductible as a charitable donation. Luckily you don’t have to take the deduction.

• And businesses have been doing their part to mitigate the devastating impact of Trump’s corporate tax cut, with some of the biggest companies in America announcing that they will voluntarily give the savings to their workers in the form of higher wages and/or bonuses. Now all that’s needed are for workers to give these bonuses back to the government, and they could basically cancel out the effects of Trump’s tax cuts!

If enough people choose to pay more than they owe and to give their bonuses and higher wages back to the government, they can help prevent or minimize the devastation and deaths that Democrats predict these tax cuts will cause. Happily, half of all Americans say they disapprove of the new tax cuts, so there will be millions of people lining up to give the government their money back!

Straw men are so useful to folk like Ryan. Just ignore the facts, create a straw man you can disparage, then go to town.

Why do so many people oppose the Republican driven tax bill?

1. Most Americans will see only very small decreases in taxes paid. They are not objecting to the decrease, but to other aspects of the bill.

2. The wealthiest Americans will see a highly disproportionate decrease in taxes, receiving a significantly larger percent decrease on their significantly larger incomes. This is the exact opposite of what the President and Republican leadership promised. Those who object object to the distribution and to the lies from the Republican party.

3. The tax reduction will erode over the next 10 years, and at the end of that time, members of the middle class will pay MORE in taxes.

4. Tax reduction for the wealthy and for corporations has NEVER paid for itself despite repeated promises to the contrary. Indeed, every time there has been a sizeable tax decrease, it was followed by one or more tax increases needed to pay the bills, increases that shifted the tax burden away from the wealthiest Americans and onto the middle class.

5. The reduction in federal services that will result will off load the responsibilities and expenses onto local and state governments, forcing them to raise their taxes or massively reduce services (and look to the disaster in Kansas that has resulted from those service cuts – cuts that have destroyed the school systems across the state – imagine what would occur in NJ if the quality of schools declines – wholesale flight and a real estate meltdown).

Mr. Ryan’s article merely ignores economic reality in support of a potentially catastrophic tax bill designed to reward what has come to be called the “donor class”. Shame on him.

guess you never took economics class

Actually quite a few. Unlike proponents of the Chicago school though, I prefer an evidence based approach to economics.

lol

Quite a few actually. I just prefer an evidence based approach to that of the Chicago school of economics.

Why do you ignore the fact that what was delivered directly contradicts what was promised?

lol

keep at it

I prefer to get my tax policy advice from economists that have mastered the finer points of posting their comments exactly once.

No. I think you get your economics from CNN.

Anonymous99……..

It’s obvious you are a political hack. What’s even worse is you actually believe what your are saying is true. How sad you haven’t learned that Obama economics was a failure and only spread the pain of over reaching government regulations and control.

7:04 – Name calling is a poor substitute for facts. Tax cuts to stimulate the economy have always resulted in massive deficits and eventual tax increases, with those increases falling primarily on the middle class. Look at the Reagan and Bush tax cuts for evidence. Forget theories. Examine facts.

wrong deficits are the results of spending end of story

Double posting resulted from the site failing to show my original post from almost an hour earlier than shown. That would not have been the first time that a viewpoint in disagreement with the original post just failed to appear, which is why I tried a second posting. I would hope that people would examine evidence and arguments rather than resorting to insults and snark, but some who post here seem to disagree with that approach.

James. You responded with faux laughter rather than with evidence when the accuracy of the source you quoted was questioned. How is that consistent with an open exchange of ideas and information?

you are more than welcome to pay more ,new jersey loves high taxes , that’s why the state is in such great shape