the staff of the Ridgewood blog

Ridgewood NJ, The American dream of homeownership is slipping away for middle-income families in 2025. With home prices skyrocketing and affordable housing options dwindling, households earning around $75,000 annually can afford just 21% of listings—less than half of what was available pre-pandemic, according to the National Association of Realtors. This alarming trend, coupled with declining construction and rising costs, is reshaping the U.S. housing market. A new report from Construction Coverage highlights where affordable housing is being built and what it means for buyers. Here’s what you need to know about the 2025 housing affordability crisis and the areas fighting back with lower-cost homes.

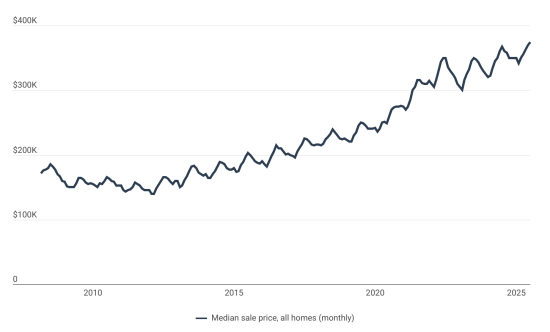

Skyrocketing Home Prices Crush Affordability

As of June 2025, the national median home sale price hit nearly $374,000—more than double its 2012 low of $140,000, per Construction Coverage’s analysis of Redfin data. While price growth has slowed since the pandemic-era surge, the damage is done: median home prices have climbed nearly $70,000 since early 2022, and high mortgage rates have driven monthly payments up by almost 60% in just three years. For middle-income buyers, this combination of elevated prices and borrowing costs, paired with sluggish wage growth (up only 55% since 2012), has made homeownership increasingly unattainable.

The shortage of starter homes remains a key issue. With fewer affordable options on the market, first-time buyers and middle-class families are being squeezed out, unable to compete in a market dominated by high-end properties.

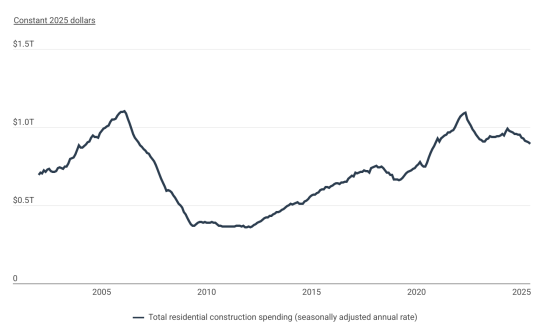

Declining Construction Worsens the Housing Shortage

The supply of new homes isn’t keeping up with demand. Real residential construction spending dropped 8.5% from June 2024 to June 2025, according to U.S. Census Bureau data analyzed by Construction Coverage. High interest rates, rising labor and material costs, and economic uncertainty have made builders hesitant to start new projects. This slowdown is particularly troubling for affordable housing, as fewer homes—especially at lower price points—are being built, further limiting options for budget-conscious buyers.

Rising Construction Costs Drive Up Home Prices

Building new homes isn’t getting any cheaper. In 2024, the average construction value per newly authorized housing unit reached $260,229, a 7.6% increase from $241,792 in 2023, per the U.S. Census Bureau. This figure, which excludes land costs, reflects the growing expense of materials, labor, and compliance with building codes. For buyers, this translates to higher home prices, even for newly built properties, making affordability an even greater challenge.

Where Affordable Housing Is Still Being Built

Despite the national trend of rising costs, some states and cities are prioritizing lower-cost housing. According to Construction Coverage, states like Delaware ($146,106 per unit) and New Jersey ($170,086) lead the nation with the lowest average construction values for new homes in 2024. Other budget-friendly states include Mississippi ($193,868), Nebraska ($200,946), Kentucky ($209,131), and New York ($219,404). These areas, primarily in the Southeast, Northeast, and Midwest, are focusing on more attainable housing options.

Among large metro areas (populations over 1 million), Omaha, NE ($172,691), Richmond, VA ($180,794), and New York, NY ($182,378) reported the most affordable new construction. Other metros like Los Angeles, CA, Philadelphia, PA, and Austin, TX also had construction values below the national average, offering hope for buyers seeking more affordable homes.

In contrast, high-cost coastal metros like Miami, FL ($391,718), San Francisco, CA ($369,681), Portland, OR ($341,810), and Boston-Cambridge ($337,227) focus on pricier developments, driven by expensive materials, strict regulations, and demand for luxury properties.

Multi-Family Housing: A Growing Solution

The report also highlights a shift toward multi-family housing, such as apartments and condos, which often provide more affordable options than single-family homes. In many metro areas, a significant share of new units authorized in 2024 were multi-family, helping to address the affordability gap. This trend is particularly strong in urban centers where land is scarce and demand for housing is high.

What This Means for Homebuyers in 2025

For middle-income buyers, the 2025 housing market remains a tough landscape. With only 21% of listings affordable for households earning $75,000, and new construction slowing, the path to homeownership is fraught with challenges. However, areas like Delaware, New Jersey, Omaha, and Richmond offer glimmers of hope, with builders focusing on lower-cost homes that could ease the burden for first-time buyers.

To explore the full data, including detailed breakdowns of housing values, permitting activity, and multi-family construction across 380+ U.S. metros and all 50 states, check out the Construction Coverage report. High-resolution graphics are available for download to visualize these trends.

How to Navigate the 2025 Housing Market

-

Research affordable regions: Focus on states and metros like Delaware, New Jersey, Omaha, and Richmond for more budget-friendly options.

-

Consider multi-family homes: Apartments and condos may offer lower entry points into the housing market.

-

Monitor interest rates: Keep an eye on mortgage rate trends, as even small decreases could improve affordability.

-

Work with a real estate professional: An expert can help you find affordable listings and navigate competitive markets.

The housing affordability crisis isn’t going away soon, but understanding where builders are investing in lower-cost homes can help buyers make informed decisions. For more insights, visit Construction Coverage.

Source: Construction Coverage analysis of U.S. Census Bureau and Redfin data. Graphics courtesy of Construction Coverage.

Tell your story #TheRidgewoodblog , #Indpendentnews, #information, #advertise, #guestpost, #affiliatemarketing,#NorthJersey, #NJ , #News, #localnews, #bergencounty, #sponsoredpost, #SponsoredContent, #contentplacement , #linkplacement, Email: Onlyonesmallvoice@gmail.com

Middle income is code for mostly lazy millennial types. If you work harder you can afford more. Very simple.

Not true. You need to make more money you can have extremely hard jobs physically, doesn’t mean you’re gonna make a lot of money.

No one said anything about the physicality of the work involved — you added that. Most people understand that “harder” in the above context does not equate to physical exertion, nor is it even remotely implied.

I’m tired of hearing the same crap

When I bought my first home in 1983 fixed rate mortgages were 18 percent and variables were 13.75

For many years the whiners have benefited from cheap money.

Seems ironic that there are endless “affordable housing” projects being built in every NJ town yet housing has never been more expensive. Who is moving into all of these affordable housing units? Who gets to decide?

Expensive for you and yours, soon to be prohibitively so — the affordable units are for your replacements.