Pushing on a String: Fed Weighs Cutting Interest On Banks’ Reserves After ECB Move

By Caroline Salas Gage and Liz Capo McCormick – Jul 30, 2012 12:00 AM ET

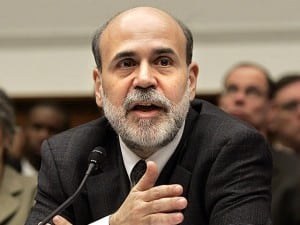

Federal Reserve Chairman Ben S. Bernanke may be taking another look at cutting the interest rate the Fed pays on bank reserves to bring down short-term borrowing costs and spur the slowing U.S. expansion.

Bernanke testified to Congress on July 17 that reducing the rate from its current 0.25 percent is one of several easing steps the Fed might take to reduce unemployment stuck above 8 percent for more than three years. In February, by contrast, the Fed chairman told Congress that lowering the rate might drive away investors from short-term money markets.

“They’re reconsidering it,” said Ward McCarthy, a former Richmond Fed economist. A July 5 decision by the European Central Bank to cut its deposit rate to zero is prompting renewed interest in the strategy, said McCarthy, chief financial economist at Jefferies & Co. McCarthy said it’s unlikely the Fed will reduce the rate at a two-day meeting that starts tomorrow.

Policy makers meeting this week are looking for new monetary tools after the Fed lowered its benchmark interest rate to near zero in December 2008 and purchased $2.3 trillion of securities to spur the economy. A government report on July 27 showed economic growth slowed to a 1.5 percent annual rate in the second quarter as consumers curbed spending.

“They are at the end of their rope and are probably searching for every last option for what they can do,” said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York and a former economist for the Fed Board in Washington. “You can’t rule anything out because they’re going to flail around and try every last thing they can.”