the staff of the Ridgewood blog

In recent weeks, the term rare earth elements—or “rare earths”—has gone from obscure scientific jargon to a national security headline. Why? Because these 17 metallic elements are essential to everything from smartphones and electric vehicles to fighter jets and wind turbines—and China controls nearly the entire supply chain.

What Exactly Are Rare Earth Elements?

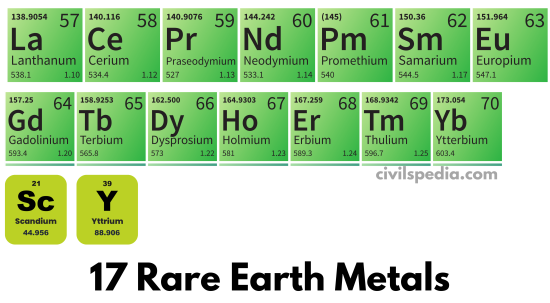

Rare earth elements (REEs) include the 15 lanthanides, plus scandium and yttrium. Despite the name, they’re not actually rare—they’re widely distributed around the globe. What makes them critical is their unique chemical properties that are hard to replicate.

REEs are vital in modern tech, including:

-

Smartphones & headphones

-

Electric vehicle motors

-

Wind turbines

-

MRI machines

-

F-35 fighter jets

-

Nuclear submarines

-

Predator drones

They even help refine petroleum, brighten your TV, and enable powerful permanent magnets used in compact electronics.

How China Took Control of the Rare Earth Industry

In the 1980s, the U.S. was the global leader in rare earth mining and processing—thanks to the Mountain Pass mine in California, operated by Molycorp. The U.S. not only mined rare earths but also pioneered their processing and created the world’s strongest permanent magnets through GM’s Indiana-based company, Magnequench.

But then Molycorp made a deal with Chinese companies, sharing its blueprints for separation facilities. That knowledge spread rapidly in China, leading to an explosion of domestic production.

With lower labor costs, lax environmental rules, and government backing, China undercut U.S. prices—and by the 1990s, China had overtaken the U.S. in refining and production.

As China’s dominance grew, it began to weaponize its rare earth monopoly:

-

2010: Temporarily banned exports to Japan.

-

2023: Outlawed rare earth processing technology exports.

-

2024: Tightened restrictions in response to U.S. tariffs.

Can the U.S. Make a Comeback?

In response, the U.S. has begun reinvesting in its rare earth industry:

-

The Department of Defense has allocated $439M (2020–2024) to companies like MP Materials and Noveon Magnetics to rebuild domestic capabilities.

-

The U.S. increased rare earth oxide production from 7k metric tons in 2014 to 45k in 2024, primarily at Mountain Pass.

MP Materials has even started processing and manufacturing neodymium magnets in Texas—used in smartphones and military equipment.

But Here’s the Catch…

While U.S. production is rising, most of the processing still happens in China. China produces around 300k metric tons of magnets annually—compared to MP’s goal of just 1k tons.

Even if the U.S. could match China technically, does the market demand support it? Rare earths make up a tiny slice of global materials use, and the Pentagon’s needs are estimated at just 0.1% of global demand.

And with EV sales slowing and research into non-rare-earth magnets growing, the long-term demand is still uncertain.

So What’s Next?

While the U.S. may never reclaim its former dominance, diversifying supply chains and investing in allied countries like Brazil or India could mitigate risk. According to rare earths expert Jack Lifton, the key question isn’t just technological—it’s economic.

“People tell me, ‘I’m gonna build a rare earth metal plant.’ I say, ‘For what reason? Who are you going to sell it to?’”

Still, with growing concern over energy independence and national security, rare earths will remain in the spotlight. And for Lifton—who’s been in the game since the 1960s—this latest boom might just be the busiest chapter yet.

Take the Wall Street Walking Tour https://www.facebook.com/unofficialwallstreet

#WallStreetTours,#FinancialDistrictExploration, #ExploreWallStreet, #FinancialHistoryTour, #StockMarketExperience, #FinancialDistrictDiscovery, #NYCFinanceTour,#WallStreetAdventure