the staff of the Ridgew3ood blog

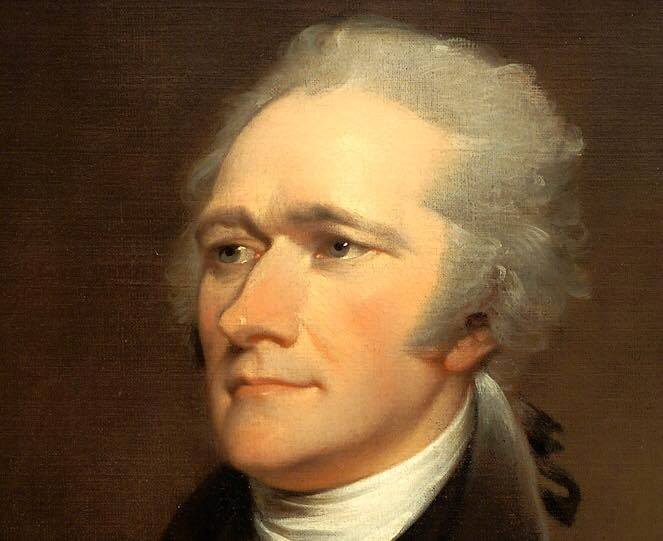

WASHINGTON, D.C. — Long before today’s debates over the national debt and fiscal policy, America’s first Treasury Secretary, Alexander Hamilton, laid the foundation for a strong financial future by harnessing the power of tariffs to pay down debt and unify a young nation.

On September 11, 1789, the U.S. Senate confirmed President George Washington’s appointment of Hamilton as the first Secretary of the Treasury. Within days, Hamilton was already at work addressing the country’s massive war debt—estimated at $79 million—and restoring its financial credibility.

Hamilton’s Bold Vision: Use Tariffs to Fund the Nation

Hamilton’s financial strategy centered on one key concept: revenue generation through customs duties (tariffs) and excise taxes, not through income tax (which didn’t exist yet). His plan was revolutionary—and effective.

Tariffs on imported goods provided a steady stream of income to the federal government. These revenues allowed the U.S. to:

-

Establish public credit

-

Pay down Revolutionary War debts

-

Support a national bank

-

Fund infrastructure and the military

-

Maintain national honor in the eyes of international creditors

“The proper funding of the present debt will render it a national blessing,” Hamilton famously argued.

📈 How Tariffs Helped Pay Off U.S. Debt

In his 1790 Report on Public Credit, Hamilton laid out a comprehensive plan to consolidate state and federal debts under the national government and gradually eliminate them using revenue from tariffs. These import taxes—targeting foreign goods—were designed not only to protect domestic industry but also to generate the funds needed to stabilize the country’s finances.

With this approach, Hamilton aimed to build national unity: shared debt meant shared responsibility—and shared prosperity.

💥 Opposition and Compromise

Hamilton’s plan wasn’t without controversy. Critics like James Madison feared it rewarded speculators and centralized too much power in the federal government. The most heated debates centered around the redemption of wartime securities and the federal assumption of state debts.

The deadlock ended with the Compromise of 1790, famously brokered over a dinner with Thomas Jefferson. In exchange for Southern support of Hamilton’s financial plan, the nation’s capital was moved to what would become Washington, D.C.

🏦 A National Bank and a Legacy of Growth

After securing tariffs and debt assumption, Hamilton introduced his Report on a National Bank in December 1790. Despite some constitutional concerns, President Washington approved it—believing it was essential to carrying out the financial powers granted to Congress.

The result? An economic boom. With a stable currency and access to credit, American industry and commerce flourished. The U.S. not only paid down its debt—it also gained the confidence of global markets and began charting a path toward long-term independence and prosperity.

💡 Modern Takeaway: Tariffs Can Strengthen National Finances

While the debate over tariffs continues today, Hamilton’s legacy proves they can play a key role in reducing debt and building economic infrastructure, particularly in a developing nation.

His system worked: tariff revenue helped retire debt, boost trade, and unify a fractured country, paving the way for America’s rise as a global power.

Take the Wall Street Walking Tour https://www.facebook.com/unofficialwallstreet

#WallStreetTours,#FinancialDistrictExploration, #ExploreWallStreet, #FinancialHistoryTour, #StockMarketExperience, #FinancialDistrictDiscovery, #NYCFinanceTour,#WallStreetAdventure

July 11, 1804 Hamilton had a very bad day in Weehawken, NJ