the staff of the Ridgewood blog

Ridgewood NJ, Out With the Old, In With the ETFs: How Younger Generations Are Flipping Retirement Planning on Its Head

There’s a retirement revolution happening—and it’s being led by Gen Z and Millennials. According to a recent Investors Observer report, the traditional 401(k) playbook followed by Baby Boomers is being tossed out in favor of high-growth, tech-focused, and even crypto-based investment strategies.

While Boomers remain loyal to low-cost index funds and steady-income strategies, younger generations are taking bold steps toward thematic ETFs, international markets, and emerging technologies. The result? A completely different roadmap to retirement—and potentially, radically different outcomes.

📊 Key Data: Generational Differences in 401(k) Investing

ETF Adoption Soars Among the Young:

-

🔹 Gen Z: 75% hold ETFs in their 401(k)s

-

🔹 Millennials: 81%

-

🔹 Boomers: Only 60%

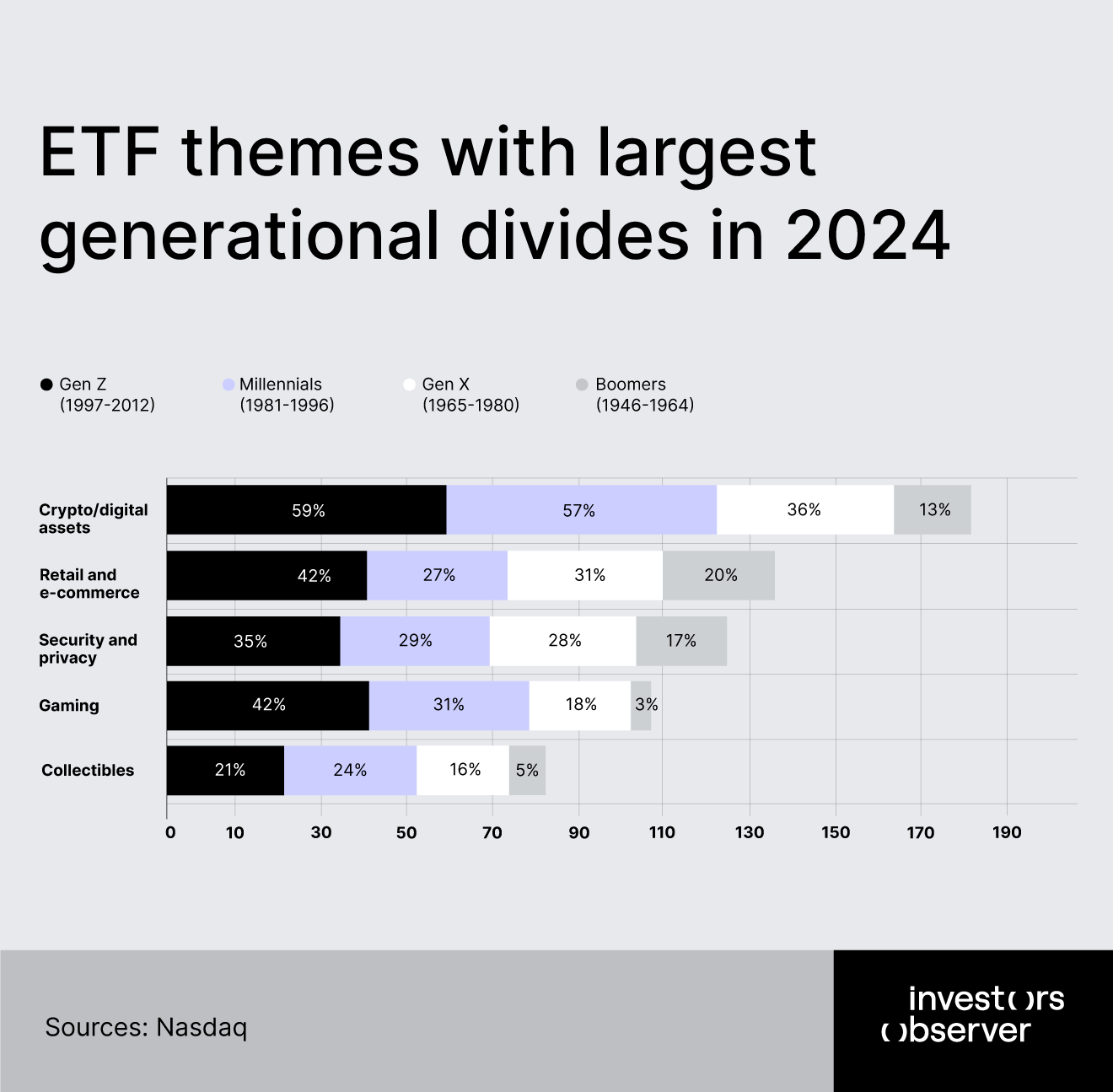

Crypto & Digital Assets Are No Longer Fringe:

-

🚀 Gen Z: 59% hold crypto/digital asset ETFs (up from 26% in 2023)

-

🚀 Millennials: 57% (up from 30%)

-

🧓 Boomers: Just 13% (a modest rise from 7%)

AI and Fintech ETFs See Explosive Growth:

Younger investors are embracing ETFs tied to artificial intelligence, fintech, and innovation-driven sectors—often outperforming legacy funds and delivering more aggressive returns.

🔥 Hot Performance: The New Stars of the 401(k) Scene

-

YieldMax MSTR Option Income Strategy ETF: +105.98% return

-

Fidelity Growth Strategies (Mutual Fund): +22% annual gain

-

Dimensional International Value ETF: +21.44% YTD

Clearly, it pays to think beyond borders and traditional sectors.

🌎 Global Diversification & Thematic Strategies

Gen Z and Millennials are going global—literally. Their 401(k) portfolios include international and emerging market ETFs, reflecting a hunger for growth beyond U.S. borders. This generation isn’t just investing in markets—they’re investing in trends: AI, fintech, robotics, and even space tech.

Boomers and Gen X, meanwhile, prefer the tried-and-true: real estate, healthcare, and broad-market index funds.

💸 Fees & The New Retirement Math

-

Younger generations are getting smart about costs. ETFs typically come with lower fees, allowing Gen Z and Millennials to maximize long-term returns.

-

High-fee funds? Not worth the hype. Research shows they rarely outperform—and often underdeliver compared to low-cost options.

-

Chasing yield in “safe” income ETFs can result in long-term underperformance, especially when market growth outpaces fixed returns.

⚖️ Risk vs. Reward: Generational Investing Mindsets

| Generation | Style | Risk Tolerance | Investment Focus |

|---|---|---|---|

| Gen Z | Aggressive | High | Crypto, AI, Emerging Tech |

| Millennials | Growth-Oriented | Moderate-High | ETFs, Global Equity, Innovation |

| Gen X | Balanced | Moderate | Real Estate, Healthcare |

| Boomers | Conservative | Low | Broad Index Funds, Bonds |

🧠 Expert Insight

Finance analyst Sam Bourgi of Investors Observer breaks it all down: “We’re seeing a generational shift in how Americans think about retirement. With pensions gone and markets more volatile than ever, younger investors are rewriting the rules.”

His full report is packed with charts, analysis, and tips on navigating the 401(k) landscape by generation. Read it here.

🎯 Final Thoughts

The bottom line? The days of “set it and forget it” retirement planning are over. Gen Z and Millennials are not just investing—they’re strategizing, diversifying, and innovating. Whether it leads to early retirement or a rollercoaster ride of risk, one thing is certain:

The future of retirement looks nothing like your parents’ 401(k).

Take the Wall Street Walking Tour https://www.facebook.com/unofficialwallstreet

#WallStreetTours,#FinancialDistrictExploration, #ExploreWallStreet, #FinancialHistoryTour, #StockMarketExperience, #FinancialDistrictDiscovery, #NYCFinanceTour,#WallStreetAdventure