Central Bankers, Worried About Bubbles, Rebuke Markets

By JACK EWINGJUNE 29, 2014

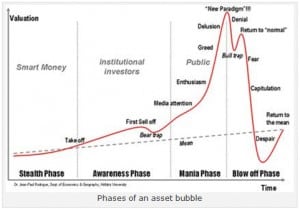

Investors, desperate to earn returns when official interest rates are at or near record lows, have been driving up the prices of stocks and other assets with little regard for risk, the Bank for International Settlements in Basel, Switzerland, said in its annual report published on Sunday.

Recovery from the financial crisis that began in 2007 could take several more years, Jaime Caruana, the general manager of the B.I.S., said at the organization’s annual meeting in Basel on Sunday. The recovery could be especially slow in Europe, he said, because debt levels remain high.

“During the boom, resources were misallocated on a huge scale,” Mr. Caruana said, according to a text of his speech, “and it will take time to move them to new and more productive uses.”

The B.I.S. provides financial services to national central banks and also acts as a setting where central bankers can discuss monetary policy and other issues like financial stability or bank regulation. The board of directors includes Janet L. Yellen, chairwoman of the Federal Reserve; Mario Draghi, president of the European Central Bank; and the heads of central banks from Japan, China, India and many other countries.

The organization, which reflects a widespread view among central bankers that they are bearing more than their share of the burden of fixing the global economy, often uses its annual reports to send a message to political leaders, commercial bankers and investors. But the B.I.S.’s language in the 2014 edition was unusually direct, as was its warning that the world could be hurtling toward a new crisis.

“There is a disappointing element of déjà vu in all this,” Claudio Borio, head of the monetary and economic department at the B.I.S., said in an interview ahead of Sunday’s release of the report.

He described the report “as a call to action.”

The organization said governments should do more to improve the performance of their economies, such as reducing restrictions on hiring and firing. The report also urged banks to raise more capital as a cushion against risk and to speed efforts to deal with past problems. Countries that are growing quickly, like some emerging markets, must be alert to the danger of overheating, the group said.

“The signs of financial imbalances are there,” Mr. Borio said. “That’s why we are emphasizing it is important to take further action while the time is still there.”

The B.I.S. report said debt levels in many emerging markets, as well as Switzerland, “are well above the threshold that indicates potential trouble.”