the staff of the Ridgewood blog

Washington DC, in a surprising political twist, whispers are growing louder in Washington that some Republicans in Congress may consider raising the top income tax rate — potentially pushing it above 40% for the first time since 1985.

Yes, you read that right. The party historically known for advocating lower taxes and limited government may be gearing up to reignite a tax hike debate — a move that could not only alienate their voter base, but also mirror the kind of policy many associate with progressive Democrats.

A Risky Flashback to a Political Mistake

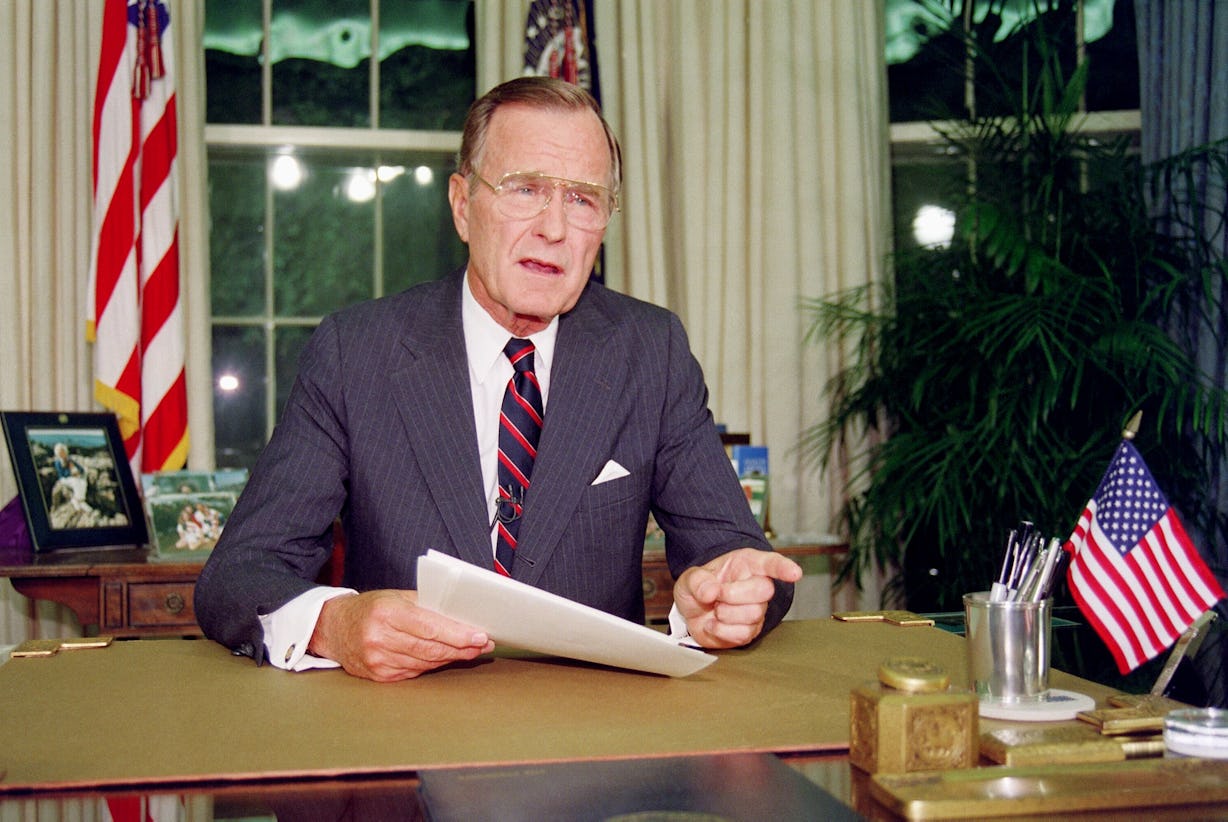

Let’s rewind to the early 1990s. Then-President George H.W. Bush “Read my lips” ,famously broke his campaign pledge by raising taxes — a political move that backfired dramatically. The fallout was brutal: voters revolted, and the Republican Party paid the price.

Since then, no president — Republican or Democrat — has raised the top statutory income tax rate above 40%. Even Bill Clinton, Barack Obama, and Joe Biden stopped short of crossing that threshold.

So, why would Republicans go there now?

Political Confusion or Economic Miscalculation?

Rumors suggest that some Republicans, possibly under pressure from White House economic advisers, are considering hiking the top income tax rate to 40% or slightly higher in the name of deficit reduction or “tax fairness.”

This would mean raising taxes higher than any Democratic administration has done in nearly four decades — a shocking about-face for a party that built its brand on economic growth through lower taxation.

Is this a strategic misstep, or have some Republicans been spending too much time at Bernie Sanders rallies?

Why a 40% Tax Rate Could Backfire

Beyond the political optics, there are serious economic implications. Raising top tax rates can lead to:

-

Reduced investment incentives

-

Slower economic growth

-

Decreased entrepreneurship and innovation

-

Increased efforts toward tax avoidance and capital flight

Simply put, raising the top tax rate could hurt the very economic engine Republicans typically seek to protect.

Will History Repeat Itself?

If Republicans move forward with a tax hike, it would mark a significant ideological shift — one that could trigger a political backlash just as it did for President Bush in the early ‘90s.

As one observer put it: “If they do, they deserve to get electrocuted by voters.” Harsh words — but they reflect the frustration many fiscal conservatives feel at the thought of a GOP-led tax increase.

Final Thoughts

As Congress debates the next big reconciliation bill, all eyes are on whether Republicans will stand by their low-tax principles — or shock voters by embracing one of the largest tax hikes in recent memory.

Take the Wall Street Walking Tour https://www.facebook.com/unofficialwallstreet #WallStreetTours,#FinancialDistrictExploration, #ExploreWallStreet, #FinancialHistoryTour, #StockMarketExperience, #FinancialDistrictDiscovery, #NYCFinanceTour,#WallStreetAdventure

Bull!

I say lets go back to when America Was Really Great… and not Again, in the late 1950’s and early 1960’s when the USA was at the top of the heap and the individual income tax rate was 90 percent. My dad was fortunate to be in that group and gladly paid his fair share to support the ideals of a democracy that led the world in every aspect. Today, we are soft, greedy and unable to comprehend what has made us great in the past but rather look to find scapegoats to blame for one’s own failures in life.

Only way to save the economy outside of more printing is massive tax increases and even more massive spending cuts. The math doesn’t work any other way and no one in DC has the ability to do what needs done.

It was a good empire while it lasted. They all end eventually. Its not if, its when.