The inflation panic : The spontaneous combustion theory of inflation

Jun 26th 2014, 15:42 by G.I. | WASHINGTON, D.C.

In the last few weeks, ominous warnings of inflation’s imminent resurgence have multiplied, prompted by recent upside surprises on core inflation and the cavalier dismissal by Janet Yellen, the Fed chair, of those reports as “noise. ”

On factual, theoretical and strategic grounds, I find the panic over inflation perplexing.

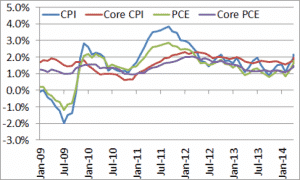

First, factual. Yes, core CPI inflation has rebounded to 2% from 1.6% in February and today we learned that core PCE inflation has risen to 1.5% from 1.1%. What should we infer from this? Nothing. In the short run inflation oscillates because of idiosyncratic movements in various components, such as rent, health care and imported commodities, but over longer periods, it is remarkably inertial: the best forecast of inflation over the next five years is inflation over the past five years. The nearby chart illustrates this;

https://www.economist.com/blogs/freeexchange/2014/06/inflation-panic?fsrc=rss

Everything costs twice as much as 7 years ago.

But there is no inflation…

anyone who shops for food or building supplies knows this to be true.

#1 not really. There was a commodities bubble in 2007 that drove the price of a slice of pizza north of $3, but since then the price of wheat has gone back down but pizza is still $3 a slice.

Similarly, 7 years ago housing bubbles in the US and China were driving the price of construction materials up, and since then the only thing propping up prices is collusion.

So yes, there has been inflation over the last 20 years, but it’s not just since the other guy got elected.