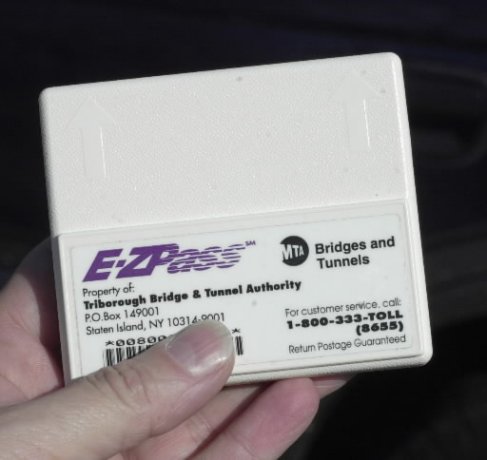

NJ Ez pass is a scam. My personal experience (I have ny account take was issued before nj had the ezpass ). My account has always been in good standing, automatic credit card reimbursement, etc. I have 4 current tags. I put a tag in my newly obtained vehicle with out of state plates while it was here for a month. The garden state parkway toll in wash twps said “tag not read”. To avoid issues, that plate was added to the account 15 minutes later. I received a violation notice (despite meeting all the criteria for NOT being a violation) demanding 1.50 toll and $50 administration fee. I replied as requested online, on the phone, and using their automated system 11 times. They kept sending their lying bs notice. I finally had the last clerk on the phone admit that “their new system was having problems “. I paid the 1.50 toll with a credit card, and made it clear if she tried to ding me the 50 I would dispute the charge and suggest that the local us attorney investigate their practices. Apparently that is how NJ tries to strong arm payments that ate NOT due from unsuspecting motorists who think they may have a registration revoked (it’s not possible ). NJ EZ pass is a corrupt organization (based on my personal experience) and should be investigated. If it was a private company the executives would be indicted for mail fraud wire fraud and corruption for extorting money from motorists that is not due.