December 23,2017

the staff of the Ridgewood blog

Ridgewood NJ, in “A GUIDE TO PAYING HIGHER TAXES FOR PEOPLE UPSET BY THE TAX BREAKS” by Kevin Ryan, the author spells out how you can continue paying the old higher rates .

Ryan begins , “Are you upset about the tax cuts? Have no fear! I’ve written this handy guide for people who’d like to continue paying higher taxes.”

He reminds taxpayers , “It’s not as simple as sending the government more money than your tax return says you owe. Unfortunately, the IRS will send your overpayment back to you as a refund (or apply it toward your next year taxes if you specify them to). ”

Then he gets into the options you have to pay more taxes .

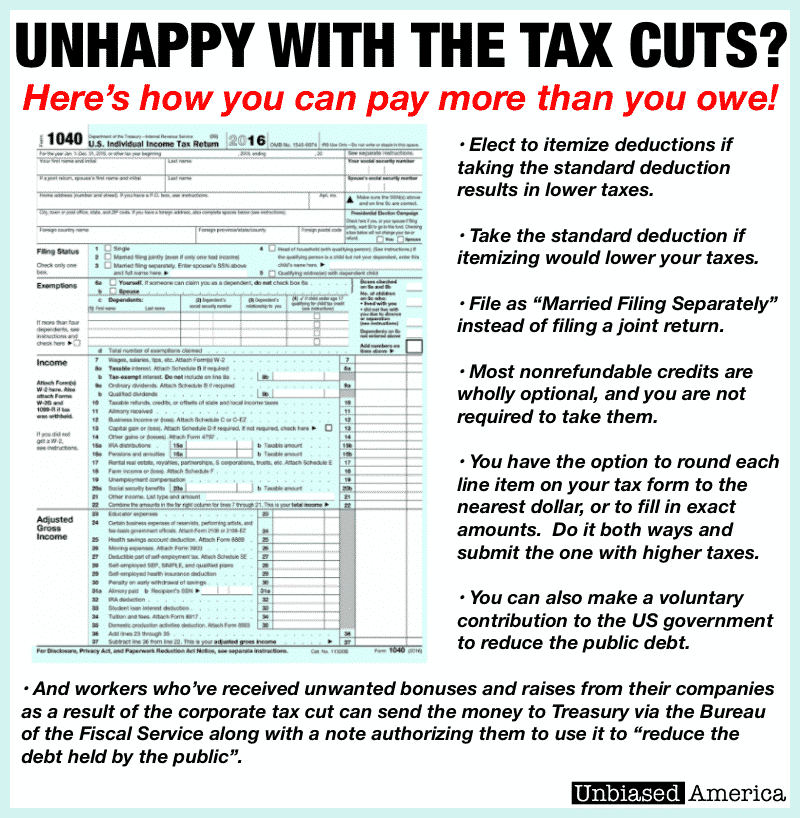

However, there are options that you can select when filing your taxes that will result in you paying more money:

• Elect to itemize deductions even if the standard deduction would be greater.

• Elect to take the standard deduction if itemizing would lower your taxes.

• File as “Married Filing Separately” instead of filing a joint return will usually result in higher taxes owed.

• Most nonrefundable credits are wholly optional, and you are not required to take them if you do not want to.

• You have the option to round each entry line item on your tax form to the nearest dollar, or to fill in exact amounts. Do it both ways and submit the result that comes out with higher taxes.

• You can also make a voluntary contribution to the US government by sending a separate payment to the Treasury via the Bureau of the Fiscal Service along with a note authorizing them to use it to “reduce the debt held by the public”. Be careful, though, such contributions are tax deductible as a charitable donation. Luckily you don’t have to take the deduction.

• And businesses have been doing their part to mitigate the devastating impact of Trump’s corporate tax cut, with some of the biggest companies in America announcing that they will voluntarily give the savings to their workers in the form of higher wages and/or bonuses. Now all that’s needed are for workers to give these bonuses back to the government, and they could basically cancel out the effects of Trump’s tax cuts!

If enough people choose to pay more than they owe and to give their bonuses and higher wages back to the government, they can help prevent or minimize the devastation and deaths that Democrats predict these tax cuts will cause. Happily, half of all Americans say they disapprove of the new tax cuts, so there will be millions of people lining up to give the government their money back!