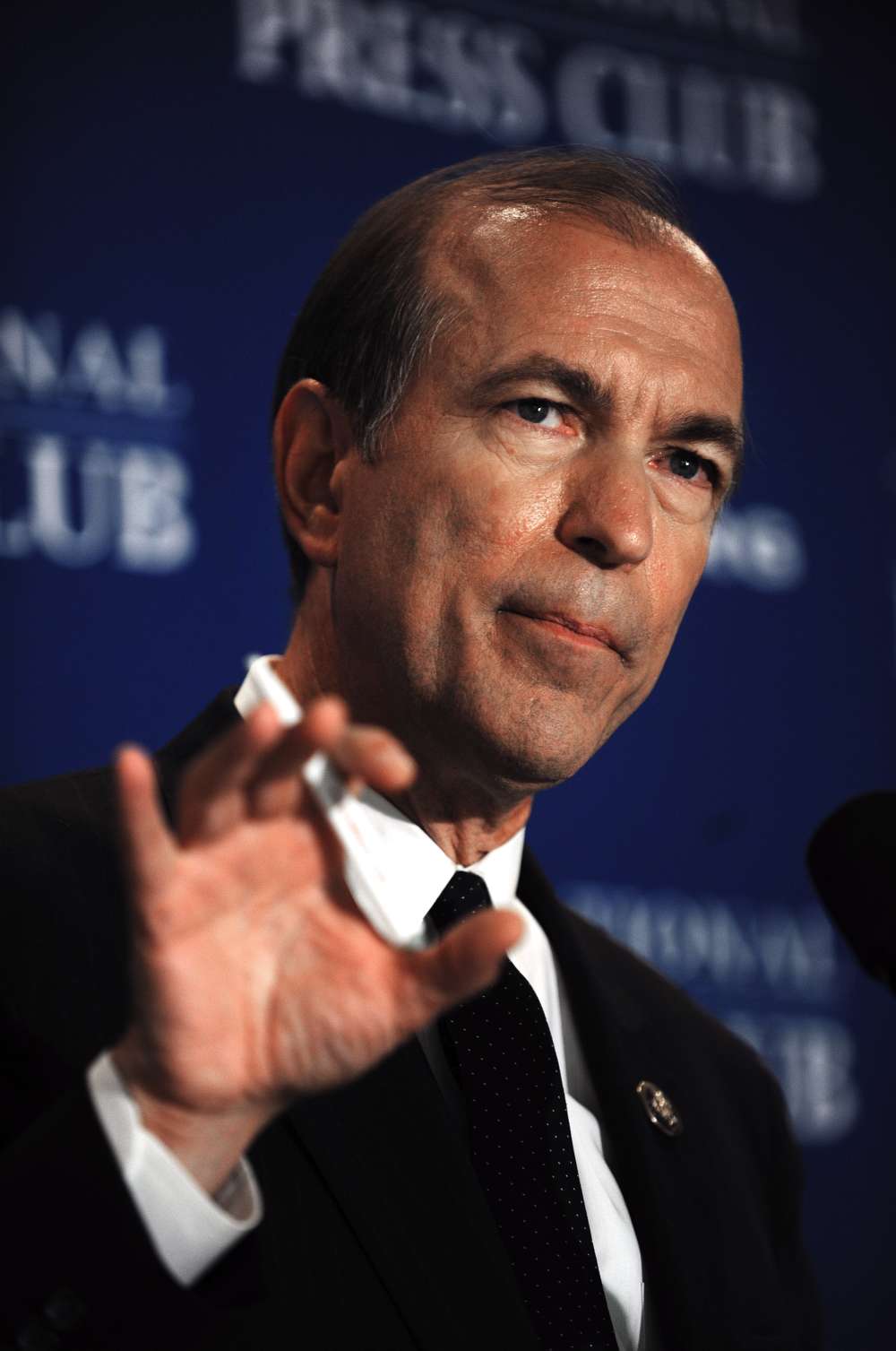

by Congressmen Scott Garrett

Ridgewood NJ, THE MOST important financial decisions in life aren’t made in Wall Street board rooms or by bureaucrats in Washington — they’re made around kitchen tables. Around these tables families look at their bills, their savings, their job prospects and their personal finances and try to figure out how to get ahead in this terrible economy. Unfortunately, the Dodd-Frank Act, the law that was enacted in 2010 with huge promises of economic recovery, has stifled the financial success of families, businesses and entrepreneurs.

And while you might not know Dodd-Frank by name, you have certainly felt its impact in your wallet. The architects of Dodd-Frank crafted an onerous maze of regulations and rules that put Washington priorities ahead of the needs of American families. Since Dodd-Frank became law, free checking has largely disappeared, and the American Dream has become more difficult to make a reality — especially if you’re self-employed — since it’s become harder to obtain a loan to buy a new house or start a business. In fact, the rate of new business start-ups is near a 20-year low, and last month’s jobs report was the worst since 2010.

Not only has Dodd-Frank made it harder for Americans to get ahead, it makes yet another bailout of Wall Street more likely. During the 2008 crisis, the taxpayers were forced to bail out big banks considered “too big to fail.” Today, those banks are bigger, and Dodd-Frank enshrines in law the expectation that taxpayers will once again be on the hook for costly bailouts.

I’m joining my colleagues on the House Financial Services Committee to propose a blueprint for American financial success. The Financial CHOICE Act — which stands for Creating Hope and Opportunity for Investors, Consumers and Entrepreneurs — is designed to revitalize economic growth through competitive capital markets. This plan will fix the problems of Dodd-Frank by increasing punishment for crooks, ending taxpayer bailouts, scaling back poorly designed regulations and holding Washington accountable to We the People.

Penalties for fraud

To better protect consumers, the Financial CHOICE Act imposes the toughest — and most expensive — penalties in history for fraud and deception. The Securities and Exchange Commission will have new authority to increase punishment for repeat offenders and link fines to investor losses. This will make sure that fraudsters who stole or scammed huge amounts of money from inno-cent people won’t get just a slap on the wrist for their crimes.

Our plan offers economic opportunity for all and bailouts for none. Dodd-Frank made promises to end “too big to fail” that were never kept. We can end this cycle by forcing failing institutions to file for bankruptcy. Our plan reforms the bankruptcy code to protect taxpayers and instill much-needed market discipline. Taxpayers shouldn’t be on the hook for the mistakes of big banks and Wall Street, and under our plan they never will be again.

One of the key tenets of the Financial CHOICE Act is an optional “off-ramp” for financial institutions to break free of Washington’s one-size-fits-all rules. But the condition for being free of excess regulation is a strong capital standard, which means that banks will be forced to hold assets to back up their liabilities. By passing the CHOICE Act, we can both manage liabilities and let banks do what they do best: invest in the next American Dream.

Washington desperately needs transparency. Dodd-Frank created bureaucracies like the Consumer Financial Protection Bureau that gave immense power to a single, politically appointed director who makes economic decisions on your behalf. The CFPB tells you what financial products you can have or not have because they think they know what’s best for you when it comes to loans, mortgages and car purchases.

Our plan makes the CFPB, and other unaccountable agencies, into bipartisan commissions. We would also require all financial regulations to undergo strict cost-benefit tests to make sure they’re not doing more harm than good. And we would change the system to ensure that all major financial regulations are approved by Congress before they are imposed on the American people.

Resistance by banks

I expect that it will be difficult to get support for bottom-up solutions like the Financial CHOICE Act in Washington. This plan is hated by big banks and crony capitalists that are all going to lose influence and power over the rest of America if this bill is passed. However, I believe that Congress can make this necessary reform with the support of people who are more concerned about the financial decisions made around kitchen tables than they are with protecting the interests of Washington insiders.

People in northern New Jersey don’t need economic reports to tell them that the economy is still in bad shape. We see it every day in our bank accounts and in our towns. Recovery can happen, and we can be prosperous again, but it has to start in our communities — not in Washington. The Financial CHOICE Act can help make that possible.

Rep. Scott Garrett, R-Wantage, serves New Jersey’s 5th Congressional District. He is chairman of the Financial Services Subcommittee on Capital Markets and Government-Sponsored Enterprises.